Sample Certified Payroll Report: Interact With an Example WH-347

March 21, 2019

What Is Certified Payroll?

Certified payroll refers to weekly construction labor reporting that a contractor submits for each government contract they’ve worked. This, along with a signed statement of compliance, “certifies” to federal, state, or local agencies that laborers on the project have earned at least the required “prevailing” — or standard — wages.

Federal, state, and local wage laws determine whether a prevailing wage is required for public works contracts, but each contracting agency may determine its own prevailing wage rate requirements. These represent a standard rate of compensation for each class or trade of construction laborer on a similar job in the same geographic area. And one way they set these is through wage-determination surveys that working contractors submit.

Similarly, each agency may use its own form and reporting procedures. Therefore, there’s no one universal certified payroll report for all cases. But some are more common than others. The U.S Department of Labor, for example, uses Form WH-347.

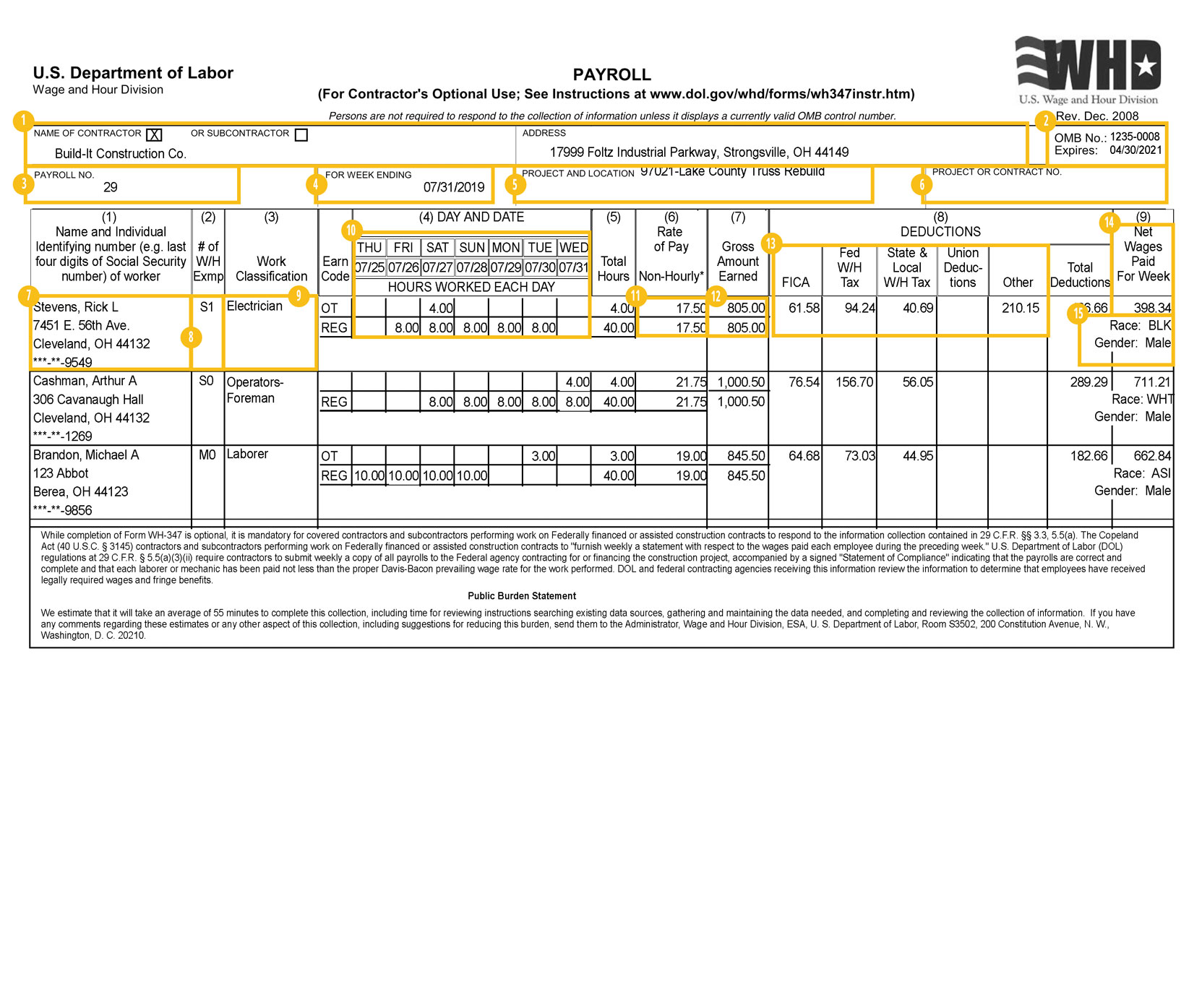

By clicking on the sample Form WH-347 below, you can learn more about the kinds of information a typical certified payroll report requires and how Payroll4Construction.com makes the process of completing it automatic by using data from your processed payrolls.

(Find out Why You Should Review Pre-Check Reports.)

Sample Certified Payroll Report

Page 1: Certified Payroll Reporting

Name of Contractor or Subcontractor and Address

First, select whether you’re the prime contractor or subcontractor on the project by checking only one box. In Payroll4Construction.com, this part is completed automatically using a field called Contract Type under the “Addl” tab of the job record.

Second, enter your firm’s name below along with the complete mailing address for your firm’s primary place of business. Payroll4Construction.com prints these using the system settings.

OMB No. and Expires

“OMB” is short for “Office of Management and Budget,” and an OMB control number is assigned with an expiration date to each government form. For example, Form WH-347’s OMB Control No. 1235-0008 expires 04/30/2021.

Payroll4Construction.com prints this information automatically for the appropriate certified payroll form selected.

Payroll No.

Identify the actual number of payroll week performed for this job.

Payroll4Construction.com will determine this number using the timecard history on the project, but clients can also adjust it as needed using the Certified P/R Job Start Date field under the “Payroll” tab of the job record.

For Week Ending

This will be the date of the last day of the report’s workweek. In Payroll4Construction.com, it’s pulled from the date ranged selected to run the report.

Project and Location

Enter the name of the project and its full address. Payroll4Construction.com will do this automatically based on the timecard history, and the address will print as it appears under the “A/R” tab of the job record.

Project or Contract No.

Enter the name of the project and its full address.

Payroll4Construction.com will do this automatically based on the timecard history, and the address will print as it appears under the “A/R” tab of the job record.

Employee Name

Use a full name along with a personally identifiable number for each worker on the payroll for this job on the current week. The Department of Labor suggests using only the last four digits of the employee’s social security number.

Payroll4Construction.com uses the timecard history to identify the appropriate employees for each certified payroll report and pulls their name, address and social security digits from the system database.

# of W/H Exmp

According to the Department of Labor, this column is not required by regulations but may be used if helpful for your recordkeeping.

Payroll4Construction.com codes information in this column by identifying whether the employee files as single (=S) or married (=M) along with the number of exemptions claimed based on their employee record in the system.

Work Classification

This should describe the work actually performed during the current workweek on the current job — not necessarily their typical work or title. The Department of Labor suggests consulting with contract specifications, the contracting officer or an agency representative. A laborer may also have more than one classification on this report if you can provide an accurate breakdown of their hours.

Payroll4Construction.com uses the description from the trade identified on the worker’s timecards for these labor hours to print this information for you.

Day and Date

First, enter each day in your payroll week, keeping in mind that your payroll week may begin on a different day than the calendar week (e.g., Monday instead of Sunday). Next, identify the date for each day of the week. Finally, separately list the straight time and overtime hours under each appropriate date for each employee.

Payroll4Construction.com completes all of this automatically.

Rate of Pay

In the box that lines up with straight time hours worked, list the actual hourly rate paid for straight time. If you paid any cash in lieu of fringes, show that rate separately using a “/” for example. Then, do the same for your overtime rates.

Payroll4Construction.com completes this automatically based on the earn codes defined on the worker’s timecards.

Gross Amount Earned

In addition to listing the gross amount earned this week on this project, separately indicate the gross amount earned on all projects for the current week. The second number would necessarily include the first number in it and has to be larger.

Payroll4Construction.com calculates this number automatically.

Deductions

Show deducted for each employee for the week, beginning with FICA (social security and medicate), federal withholding and state withholding in the first two columns. If you have more than three other deduction types, the Department of Labor states that you may use the last deduction column to a show a total of all remaining “other” deductions.

Payroll4Construction.com will automatically print FICA, federal, state and union deductions in the first four columns and total any remaining deductions in the fifth column.

Net Wages Paid for Week

Identify each employees net wages for the payroll week.

Payroll4Construction.com gives you the ability here to print a worker’s net wages for all projects or just this project based on whether you’re disclosing deductions for all projects or just this project.

Race and Gender

Verify whether the agency requiring you to submit a Form WH-347 also requires you to list the race and gender for each worker on the report.

Payroll4Construction.com is able to print these automatically for contractors.

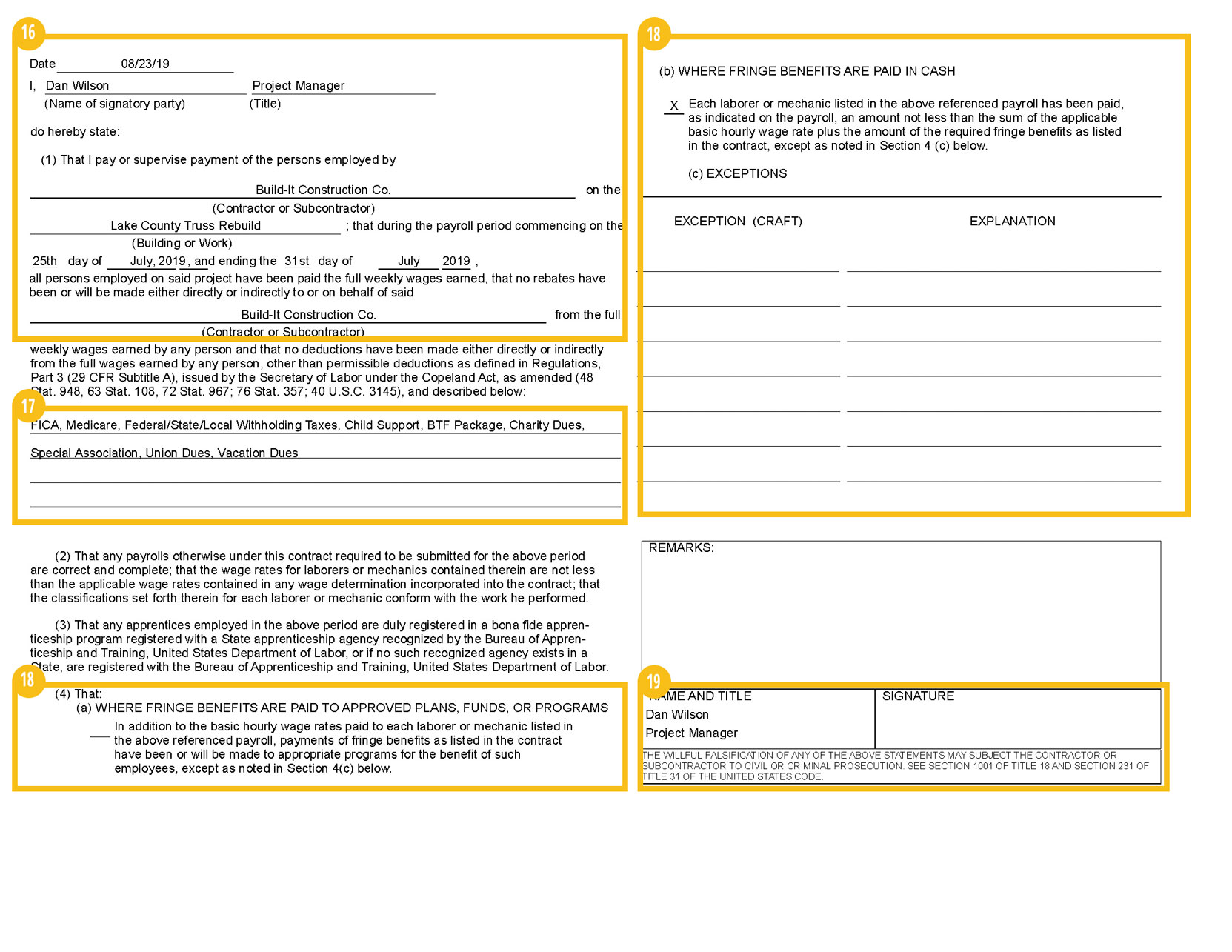

Page 2: Statement of Compliance

Statement of Compliance

The Department of Labor notes that it doesn’t require notarization the certified payroll statement of compliance but could enforce penalties for fraud against the party signing this statement. This could include a fine and imprisonment up to five years.

“Contractor or Subcontractor,” “Building or Work” and payroll period dates should match those identified on the first page of the report.

Payroll4Construction.com will print signatory party information and dates as specified in on the “Criteria” tab of the report, ensuring this information is consistent across the report.

Permissible Deductions

Describe any deductions made for this payroll. If all relevant deductions are described on the first page, the Department of Labor permits contractors to write, “See Deductions column in this payroll.”

Payroll4Construction.com can list these for you or leave the field blank at your option.

Item 4

Select the appropriate checkbox for Items 4(a) and 4(b) based on whether you’re paying all fringes to approved plans or whether you’re paying fringes in cash.

Item 4(c) exists to note any exceptions to what you’ve stated in either Item 4(a) or 4(b). In the left column, identify the excepted raft and in the right-hand column the hourly amount paid as an exception (as cash in lieu of fringes or as fringes rather than cash).

Name, Title and Signature

Name and title here should match the signatory part identified earlier on this page.

Payroll4Construction.com will again print this information for you and leave the signature field blank for you to sign.

Getting Started With Certified Payroll

Managing the various wage rates and fringe benefits for certified payroll can be taxing on any construction office. Completing it by hand can take hours or longer. However, with a cloud-based payroll service like Payroll4Construction.com, contractors can use their job-costed payroll histories to automatically complete print and electronic forms ready for filing in seconds.

Begin by previewing Payroll4Construction.com’s free payroll reports and downloading our sample report book!

Share Article